Top Stories

North American Manufacturers Cut Orders Amid Supply Chain Challenges

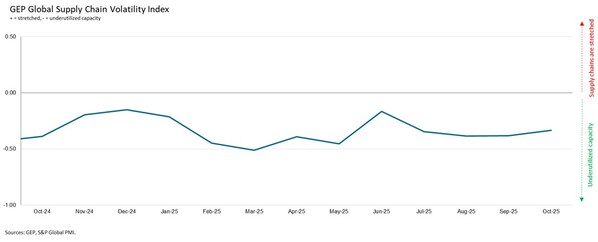

Manufacturers in North America significantly reduced their orders for raw materials and intermediate goods in October 2025. According to the GEP Global Supply Chain Volatility Index, which surveys approximately 27,000 businesses worldwide, this decline marks the steepest drop since May and indicates a potential cooling of production in the region.

The Volatility Index recorded a value of –0.33 for October, illustrating that global supply chain capacity remains underutilized. Manufacturers across major economies have been maintaining lean inventories while curtailing new purchases of inputs. This trend in North America follows several months of stockpiling driven by tariffs earlier in the year. As firms reported both a decrease in material purchases and a slowdown in deliberate inventory building, supply chains are now operating well below full capacity.

Global Trends and Regional Insights

The situation is not isolated to North America. In Asia, a decrease in factory buying in China has countered ongoing strength in India, leading to a broader softening across the region. Meanwhile, manufacturers in Europe showed only a marginal increase in activity. Reports indicate that suppliers in Germany, France, Italy, and the United Kingdom are also restricting raw material purchases, further underscoring a sluggish industrial recovery in these economies.

Michael DuVall, Vice President of Consulting at GEP, commented, “North America is seeing the clearest sign yet of a manufacturing pullback. Manufacturers are buying less and working down inventories, which points to weaker production through the winter. With space capacity across global supply, we do not anticipate any price pressure, beyond tariffs, on buyers.”

The data highlights a broader trend of manufacturers opting for reduced purchasing amid uncertainties in the global market. With many firms favoring a cautious approach, the manufacturing landscape appears to be shifting as companies navigate current economic conditions.

The next release of the GEP Global Supply Chain Volatility Index is scheduled for 8 a.m. ET on December 10, 2025. This index, produced by S&P Global and GEP, is derived from the PMI surveys sent to companies in over 40 countries, providing vital insights into global supply chain dynamics.

For those interested in historical data, full records dating back to January 2005 are available for subscription. Further information can be found on the official GEP website.

As the global supply chain landscape continues to evolve, stakeholders will need to stay informed about these trends to make strategic decisions in their operations.

-

Business5 months ago

Business5 months agoKenvue Dismisses CEO Thibaut Mongon as Strategic Review Advances

-

Lifestyle4 months ago

Lifestyle4 months agoHumanism Camp Engages 250 Youths in Summer Fest 2025

-

Sports4 months ago

Sports4 months agoDe Minaur Triumphs at Washington Open After Thrilling Comeback

-

Sports5 months ago

Sports5 months agoTupou and Daugunu Join First Nations Squad for Lions Clash

-

Top Stories5 months ago

Top Stories5 months agoColombian Senator Miguel Uribe Shows Signs of Recovery After Attack

-

World5 months ago

World5 months agoASEAN Gears Up for Historic Joint Meeting of Foreign and Economic Ministers

-

Health4 months ago

Health4 months agoNew Study Challenges Assumptions About Aging and Inflammation

-

Business5 months ago

Business5 months agoOil Prices Surge Following New EU Sanctions on Russia

-

Entertainment4 months ago

Entertainment4 months agoDetaşe-Sabah Violin Ensemble Captivates at Gabala Music Festival

-

Entertainment4 months ago

Entertainment4 months agoBaku Metro Extends Hours for Justin Timberlake Concert

-

Top Stories5 months ago

Top Stories5 months agoRethinking Singapore’s F&B Regulations Amid Business Closures

-

Business5 months ago

Business5 months agoU.S. House Approves Stablecoin Bill, Sends to Trump for Signature