Taipei, Dec. 15 (CNA) Following the conclusion of the Central Bank of the Republic of China's (Taiwan) quarterly policy-making meeting on Thursday, CNA has compiled a summary of a post-meeting Q&A session with the bank's Governor Yang Chin-long (楊金龍).

Q: Why did the Central Bank cut GDP growth for 2023 and raise it for 2024?

Taiwan's 2023 growth rate forecast has been revised downward several times, going from an initial 1.46 percent to 1.40 percent.

Yang cited slower-than-expected destocking by manufacturers, as well as the effects on exports and subsequent impact on investments from major countries tightening monetary policy since the end of 2022.

For 2024, Yang said the global economy was expected to revive, with investments rising and domestic consumption stable.

Q: How does the central Bank view current inflation?

Yang said that the central bank had adjusted its inflation forecast upward multiple times amid soaring entertainment prices.

On top of that, a bird flu outbreak and weather conditions affected produce supply and drove up food prices, Yang added.

Inflation has become difficult to predict due to the increasing complexity of influence factors, Yang said.

Yang said global inflation had been boosted by the pandemic, global supply chain bottlenecks, and the Russian-Ukrainian war, adding that even as the pandemic passed and economies revived, the inflationary pressure source shifted from commodities to services.

Dec. 6: CPI growth hits 2.90% in November boosted by higher food prices

Q: As the central bank predicts inflation to ease up, does that imply the rate hike cycle is ending?

Tight monetary policies will only see an end when inflation rates remain lower than 2 percent, Yang said.

According to the central bank's forecast, domestic inflation for Q1 and Q2 will be above 2 percent, Yang said.

Moreover, it is generally believed that the U.S. Federal Reserve will cut rates in the latter half of 2024, so Taiwan's baseline monetary policies will likely remain tight, Yang added.

Q: The Fed has implied cutting rates three times next year, will Taiwan follow suit?

Yang said that Taiwan's policies are indeed influenced by the global market, especially the United States' monetary policies.

Even so, Yang said, Taiwan does not necessarily follow whenever the Fed cuts rates. Taiwan's monetary adjustments are more gradual compared to the U.S.

While Taiwan's rates are unlikely to drop in the first half of 2024, uncertainties remain, Yang said.

Acknowledging that the central bank had come in for criticism for its "inaccurate" forecasts," Yang said it would be more careful when facing market volatility in the future.

Dec. 14: U.S. dollar dips to below NT$31.3 on dovish Fed

Q: Will foreign investments return to Asia on the occasion that the Fed reverses its current policy? How may such events influence Taiwan's finance market?

The U.S. dollar is a crucial variable for the global financial cycle, Yang said, noting that any policy changes by the Fed affect the dollar's value and in turn capital flows

However, the flow of hot money is often unpredictable and sometimes extreme, Yang said.

Past experiences indicated that short-term, large-sum capital flows results in large fluxes of the finance market, Yang added.

Oct. 7: Foreign investors record net sell of NT$77 billion shares in Taiwan Jan.-Sept.

Q: Has the housing market achieved a soft landing? Will the central bank consider retiring current selective credit controls in 2024?

While no clear definition of a soft landing for a housing market exists, at least two conditions should be met: housing prices gradually decreasing and dampening speculation, Yang said.

Currently, housing prices have slightly dropped, but growth rates remain positive, meaning that controls will continue, Yang added.

Meanwhile, the central bank is also closely watching the market for signs of the housing bubble and to ensure that credit does not concentrate too much on real estate, Yang said.

Yang said the central bank would work with the Financial Supervisory Commission R.O.C. (Taiwan) on another pressure test.

Nov. 9: Housing market in northern Taiwan stays stable in November

Q: Will Japan's central bank policy adjustments result in the appreciation of the Japanese yen?

Yang said that while Japan's current monetary remained loose, the yen may be stronger if policies change.

However, Yang said, the yen's current appreciation is due in part to the market speculating about rate cuts for the greenback.

The dollar plays a crucial role in global currency value, Yang said, adding that when the dollar appreciates, other currencies depreciate, and vice versa.

Yang noted that the situation had been this way since the pandemic.

As for Taiwan's foreign exchange, because currency values are interlinked, the Taiwan dollar cannot decide on its value solely on its fundamentals, Yang said.

This has been especially true as capital flows have dominated the exchange market since the end of the pandemic, Yang added.

Related News

Dec. 14: Central bank raises Taiwan's GDP growth forecast to 3.12% for 2024

Dec. 14: Central bank leaves interest rates unchanged

Nov. 28: Taiwan's 2023 GDP growth forecast cut to 1.42%, lowest since 2008: DGBAS

![Four things to know about Bongkrekic acid]() Four things to know about Bongkrekic acidAfter a recent deadly food poisoning outbreak at the Xinyi branch of Malaysian restaurant chain Polam Kopitiam in Taipei caused two deaths, Bongkrekic acid was found in a blood sample taken from one of the deceased Thursday, forensic autopsy results showed.03/28/2024 11:27 PM

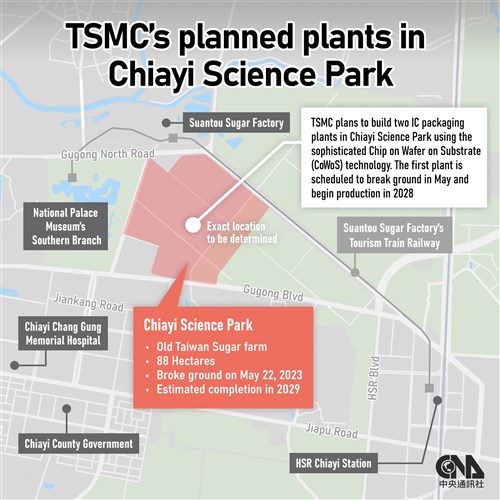

Four things to know about Bongkrekic acidAfter a recent deadly food poisoning outbreak at the Xinyi branch of Malaysian restaurant chain Polam Kopitiam in Taipei caused two deaths, Bongkrekic acid was found in a blood sample taken from one of the deceased Thursday, forensic autopsy results showed.03/28/2024 11:27 PM![Delving into TSMC's planned CoWoS packaging plants in Chiayi]() Delving into TSMC's planned CoWoS packaging plants in ChiayiContract chipmaker Taiwan Semiconductor Manufacturing Co. (TSMC) is set to build two packaging plants using the sophisticated Chip on Wafer on Substrate (CoWoS) technology at the Chiayi Science Park in southern Taiwan, with construction of the first plant scheduled to begin in May and mass production in 2028.03/19/2024 11:18 PM

Delving into TSMC's planned CoWoS packaging plants in ChiayiContract chipmaker Taiwan Semiconductor Manufacturing Co. (TSMC) is set to build two packaging plants using the sophisticated Chip on Wafer on Substrate (CoWoS) technology at the Chiayi Science Park in southern Taiwan, with construction of the first plant scheduled to begin in May and mass production in 2028.03/19/2024 11:18 PM![Taiwan's tainted chili powder problem in detail]() Taiwan's tainted chili powder problem in detailTaiwan is facing a food safety problem involving the presence of "Sudan dyes" -- red synthetic chemical dyes banned in Taiwan for use in foodstuffs -- in chili powder imported from China. CNA has compiled answers to some frequently asked questions about the issue.03/11/2024 08:31 PM

Taiwan's tainted chili powder problem in detailTaiwan is facing a food safety problem involving the presence of "Sudan dyes" -- red synthetic chemical dyes banned in Taiwan for use in foodstuffs -- in chili powder imported from China. CNA has compiled answers to some frequently asked questions about the issue.03/11/2024 08:31 PM

- Society

Thousands of Muslims gather across Taiwan for Eid al-Fitr prayers

04/10/2024 05:13 PM - Politics

New Cabinet to respond to domestic, global challenges: Lai

04/10/2024 04:55 PM - Society

Electronic pet ID card launched by agriculture ministry

04/10/2024 04:51 PM - Business

U.S. dollar closes lower on Taipei forex market

04/10/2024 04:11 PM - Business

TSMC reports highest sales for Q1

04/10/2024 03:52 PM