Taipei, Dec. 14 (CNA) The Central Bank of the Republic of China (Taiwan) said on Thursday that it has decided to leave its key interest rates unchanged after concluding a quarterly policy-making meeting that day.

The move by the local central bank had been widely anticipated by the market, in particular after the U.S. Federal Reserve left interest rates the same overnight following its latest policymaking meeting and struck a dovish tone, hinting that it plans to cut rates at least three times by 75 basis points next year.

It was the third consecutive quarter the local central bank has maintained its monetary policy with the discount rate staying at 1.875 percent, though that is still the highest level in eight years.

In addition, the rate on accommodations with collateral stays at 2.250 percent, and the rate on accommodations without collateral is also unchanged at 4.125 percent, according to the central bank.

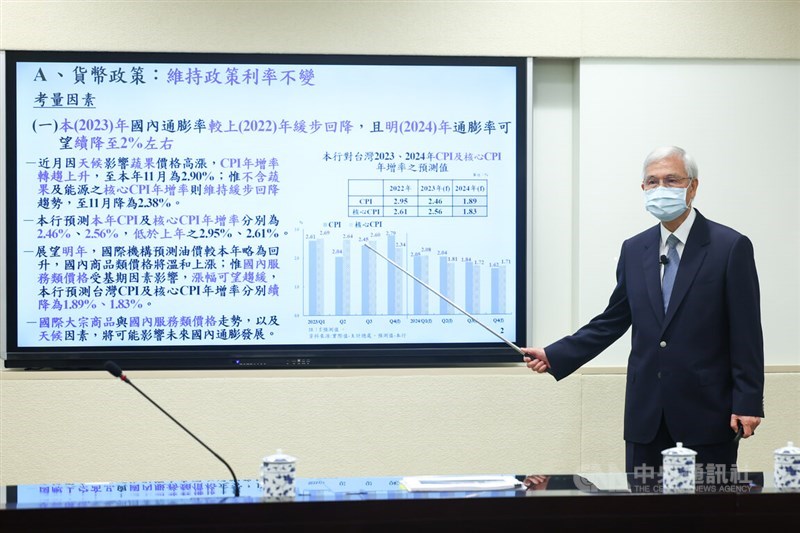

The local central bank said the decision to keep interest rates steady was unanimously supported by the bank's directors, after inflation showed signs of moderating and it looks possible the consumer price index (CPI) could fall below the 2 percent alert level set by the bank in 2024.

In the first 11 months of this year, Taiwan's CPI grew 2.48 percent from a year earlier with core CPI, which excludes fruit, vegetables and energy, up 2.60 percent year-on-year, according to the Directorate General of Budget, Accounting and Statistics (DGBAS).

The central bank said at a time when the global economy has been hit by headwinds and faces a downturn, which is likely to affect Taiwan's fundamentals, the decision to maintain monetary policy is expected to help to stabilize the local financial market.

Since March 2022, Taiwan's central bank has raised its rates by 75 basis points to combat rising inflation.

Related News

Dec. 14: U.S. dollar dips to below NT$31.3 on dovish Fed

Dec. 6: CPI growth hits 2.90% in November boosted by higher food prices

Nov. 28: Taiwan's 2023 GDP growth forecast cut to 1.42%, lowest since 2008: DGBAS

![Taiwan CPI growth slows to 2.14% in March]() Taiwan CPI growth slows to 2.14% in MarchThe local consumer price index (CPI) rose 2.14 percent from a year earlier in March, higher than a 2 percent alert set by the central bank, but the growth moderated from a 3.08 percent increase in February, the Directorate General of Budget, Accounting and Statistics (DGBAS) said Tuesday.04/09/2024 10:00 PM

Taiwan CPI growth slows to 2.14% in MarchThe local consumer price index (CPI) rose 2.14 percent from a year earlier in March, higher than a 2 percent alert set by the central bank, but the growth moderated from a 3.08 percent increase in February, the Directorate General of Budget, Accounting and Statistics (DGBAS) said Tuesday.04/09/2024 10:00 PM![Core CPI up faster over past three years than before: Central bank]() Core CPI up faster over past three years than before: Central bankA research report by Taiwan's central bank has concluded what most consumers already knew intuitively -- that prices for basic goods have risen faster since the COVID-19 pandemic hit than before it.04/09/2024 03:12 PM

Core CPI up faster over past three years than before: Central bankA research report by Taiwan's central bank has concluded what most consumers already knew intuitively -- that prices for basic goods have risen faster since the COVID-19 pandemic hit than before it.04/09/2024 03:12 PM![Taipower to raise electricity rates from Monday]() Taipower to raise electricity rates from MondayElectricity rates will rise for most consumers in Taiwan from Monday as part of a series of structured hikes determined by the Electricity Tariff Examination Council of the Ministry of Economic Affairs on March 22.03/31/2024 04:24 PM

Taipower to raise electricity rates from MondayElectricity rates will rise for most consumers in Taiwan from Monday as part of a series of structured hikes determined by the Electricity Tariff Examination Council of the Ministry of Economic Affairs on March 22.03/31/2024 04:24 PM

- Society

Thousands of Muslims gather across Taiwan for Eid al-Fitr prayers

04/10/2024 05:13 PM - Politics

New Cabinet to respond to domestic, global challenges: Lai

04/10/2024 04:55 PM - Society

Electronic pet ID card launched by agriculture ministry

04/10/2024 04:51 PM - Business

U.S. dollar closes lower on Taipei forex market

04/10/2024 04:11 PM - Business

TSMC reports highest sales for Q1

04/10/2024 03:52 PM