Taipei, Dec. 14 (CNA) The Central Bank of the Republic of China (Taiwan) said on Thursday that it has raised its forecast of the country's gross domestic product (GDP) growth in 2024 to 3.12 percent from its earlier estimate of 3.08 percent in September.

After concluding a quarterly policy-making meeting, the central bank said the upgrade came after the bank took into account a possible improvement in exports due to recovering global demand and growing popularity in emerging technologies such as artificial intelligence development.

The central bank said an increase in business opportunities created by new tech applications is expected to prompt exports-oriented manufacturers to up investment in 2024, while private consumption is forecast to grow at a mild pace.

The central bank also cited a relatively low comparison base during 2023 as one of the reasons behind the upgrade of the 2024 GDP growth forecast.

However, the central bank cut its forecast of Taiwan's GDP growth for 2023 to 1.40 percent from the previous estimate of 1.46 percent after the policy-making meeting, citing weak global demand.

The central bank appeared more cautious about 2024 than the government. In November, the Directorate General of Budget, Accounting and Statistics (DGBAS) anticipated that the local economy would grow 3.35 percent in 2024. The DGBAS predicted 2023 growth would hit 1.42 percent, in line with the central bank's forecast.

The central bank decided during Thursday's meeting to leave its key interest rates unchanged for the third consecutive quarter.

The discount rate will stay at 1.875 percent -- still the highest level in eight years. Since March 2022, the Taiwan central bank has raised its rates by 75 basis points to combat rising inflation.

The move to keep interest rates the same came after inflation showed signs of moderating, the central bank said.

The central bank said although the consumer price index (CPI) grew 2.90 percent in November following a spike in vegetable and fruit prices due to bad weather, growth had moderated from 3.05 percent in October.

In addition, core CPI, which excludes fruit, vegetables and energy, rose 2.38 percent in November, also moving lower from 2.49 percent in October, according to the central bank.

The central bank said CPI is expected to grow 2.46 percent in 2023, down from 2.95 percent in 2022, with core CPI expected to rise 2.56 percent, compared with 2.61 percent a year earlier.

With fee growth in the service sector expected to trend lower and commodity prices expected to move slightly higher in 2024, the central bank said the CPI and core CPI are forecast to continue to fall to 1.89 percent and 1.83 percent, respectively, next year, below the 2 percent alert set by the central bank, according to the bank.

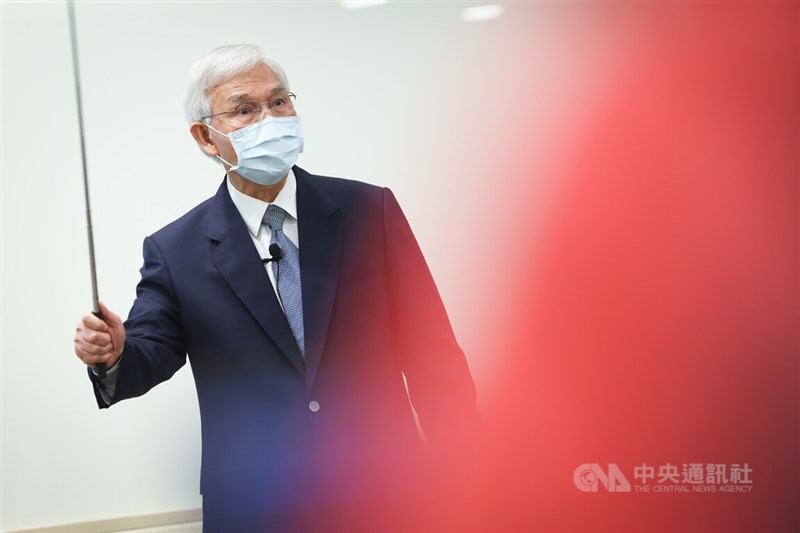

Central Bank Governor Yang Chin-long (楊金龍) told reporters that considering inflation was still above 2 percent, the bank would continue to keep interest rates at high levels into the first half of next year, suggesting rate cuts may not be possible.

Yang said unless the goal to cap CPI growth below 2 percent was met, the central bank's rate hike cycle would not be concluded.

In addition to inflation, Yang said the central bank's decision to keep interest rates unchanged came after the bank considered uncertainties faced by the global economy, which in turn affect the local economy, to stabilize the local financial market.

The central bank did not come up with any new measures to rein in home prices as it had done before.

Since December 2020, the central bank has imposed five rounds of selective credit controls on the home market by limiting mortgages to home buyers to cap market speculation.

The central bank said the credit controls, five interest rate hikes, and two increases in the required deposit reserve ratio -- the proportion of deposits that regulators require banks to hold in reserve and not loan -- have led to the growth in mortgages and lending to property developers to slow down, therefore no additional measures were currently needed.

The central bank said it will continue to monitor the local currency market, adding if the Taiwan dollar encounters any volatility, it will step in to maintain market order.

Yang said Taiwan is a small-scale open economy and is easily influenced by external factors, therefore it is necessary to make prompt responses when necessary.

Related News

Dec. 14: Central bank leaves interest rates unchanged

Dec. 14: U.S. dollar dips to below NT$31.3 on dovish Fed

Dec. 6: CPI growth hits 2.90% in November boosted by higher food prices

Nov. 28: Taiwan's 2023 GDP growth forecast cut to 1.42%, lowest since 2008: DGBAS

- Society

Thousands of Muslims gather across Taiwan for Eid al-Fitr prayers

04/10/2024 05:13 PM - Politics

New Cabinet to respond to domestic, global challenges: Lai

04/10/2024 04:55 PM - Society

Electronic pet ID card launched by agriculture ministry

04/10/2024 04:51 PM - Business

U.S. dollar closes lower on Taipei forex market

04/10/2024 04:11 PM - Business

TSMC reports highest sales for Q1

04/10/2024 03:52 PM