World

China’s Strategic Delay: Huawei Gears Up as Nvidia Returns

China’s reaction to the recent policy shift by the United States, which allows the sale of the key Nvidia H20 artificial intelligence chip within its borders, reveals a complex strategy. While the Chinese government publicly expresses concerns about potential security and environmental risks, this stance appears to serve a dual purpose: buying time for Huawei to enhance its competitive edge in the AI sector and maintaining leverage in ongoing trade discussions with the United States.

Nvidia’s Return and China’s Response

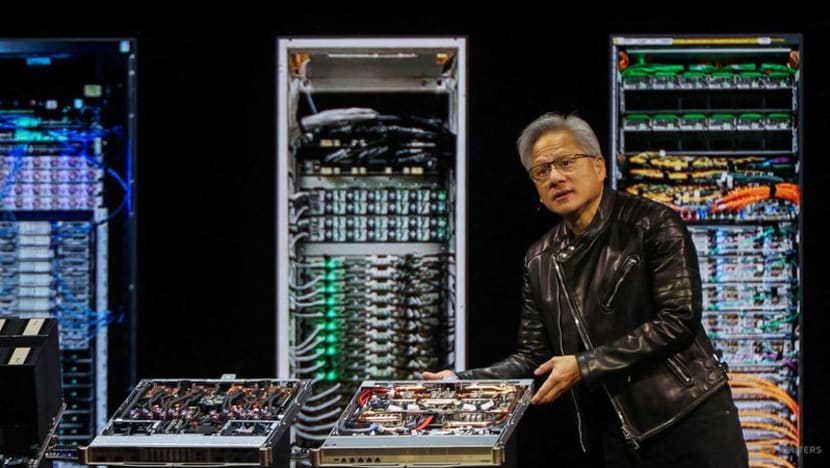

The Trump administration announced in March 2024 that it would permit the sale of Nvidia’s H20 chips, a decision that was met with enthusiasm from industry leaders in Beijing. Jensen Huang, CEO of Nvidia, received a warm welcome during a recent visit to China, suggesting that the country viewed this change as a step towards easing export restrictions that have hindered its AI development. However, since the announcement, Chinese authorities have summoned Nvidia to address purported security threats associated with the H20 chips. State media has amplified concerns about potential vulnerabilities, cautioning local companies against using these processors for AI projects.

In a recent interview with Bloomberg TV, US Treasury Secretary Scott Bessent noted that China’s reaction indicates apprehension about Nvidia chips becoming a standard in the country. While this interpretation carries a sense of optimism, the situation is more intricate than it appears.

China’s AI Landscape and Domestic Alternatives

Nvidia’s technology currently dominates China’s AI infrastructure, with major companies like Bytedance and Alibaba having stockpiled substantial orders ahead of the now-reversed ban. Despite the government’s warnings, it has not implemented an outright ban on Nvidia products, signaling that many Chinese firms remain eager to acquire H20 chips to fuel their AI ambitions. The apparent contradiction in China’s public statements suggests a calculated attempt to exert pressure on Washington while allowing its domestic industry time to catch up.

In the background, Chinese companies like DeepSeek are grappling with the limitations of domestic alternatives. Reports indicate that DeepSeek had to postpone the release of its new AI model due to difficulties in training it solely on Huawei hardware. With a team of Huawei engineers on-site, they faced challenges that ultimately led to a compromise: using Nvidia for training while relying on Huawei for inference, the phase involving the deployment of AI systems.

Beijing’s desire to promote its own technology is evident, yet the current state of domestic alternatives remains insufficient to meet the demands of the rapidly evolving AI landscape. The Chinese Communist Party’s media outlets have criticized Nvidia’s technology, yet these statements appear more aimed at instigating a reaction than issuing an official condemnation.

This is particularly significant given the unusual aspect of the recent trade landscape: the Trump administration announced that Nvidia would pay a 15% cut of its AI chip sales revenue in China. Such a transactional approach raises eyebrows internationally, particularly if the roles were reversed. This arrangement underscores the ongoing complexities of national security concerns in trade discussions.

The Future of AI in China

Despite the ongoing tensions and public posturing, it is clear that China is not entirely willing to sever ties with American technology. Companies like iFlytek have claimed to develop their models using Huawei processors, yet the preference for Nvidia remains prevalent among Chinese businesses, primarily due to its superior software ecosystem. Encouraging developers to adopt Huawei’s competing platform will be crucial to fostering a more robust domestic AI industry.

As the Chinese government navigates this delicate balance, it is working towards a future where domestic alternatives can flourish. Once this transition occurs, the impact of US-led export controls may diminish significantly, altering the dynamics of the AI market in China. For now, the 15% revenue share Nvidia agreed to pay may seem a small price for the US to pay while China builds a more independent technological foundation.

-

Business5 months ago

Business5 months agoKenvue Dismisses CEO Thibaut Mongon as Strategic Review Advances

-

Lifestyle4 months ago

Lifestyle4 months agoHumanism Camp Engages 250 Youths in Summer Fest 2025

-

Sports4 months ago

Sports4 months agoDe Minaur Triumphs at Washington Open After Thrilling Comeback

-

Sports5 months ago

Sports5 months agoTupou and Daugunu Join First Nations Squad for Lions Clash

-

Top Stories5 months ago

Top Stories5 months agoColombian Senator Miguel Uribe Shows Signs of Recovery After Attack

-

World5 months ago

World5 months agoASEAN Gears Up for Historic Joint Meeting of Foreign and Economic Ministers

-

Health4 months ago

Health4 months agoNew Study Challenges Assumptions About Aging and Inflammation

-

Business5 months ago

Business5 months agoOil Prices Surge Following New EU Sanctions on Russia

-

Entertainment4 months ago

Entertainment4 months agoDetaşe-Sabah Violin Ensemble Captivates at Gabala Music Festival

-

Entertainment4 months ago

Entertainment4 months agoBaku Metro Extends Hours for Justin Timberlake Concert

-

Top Stories5 months ago

Top Stories5 months agoRethinking Singapore’s F&B Regulations Amid Business Closures

-

Business5 months ago

Business5 months agoU.S. House Approves Stablecoin Bill, Sends to Trump for Signature