Politics

Carney’s Diplomatic Push Positions Canada as Energy Leader in Asia

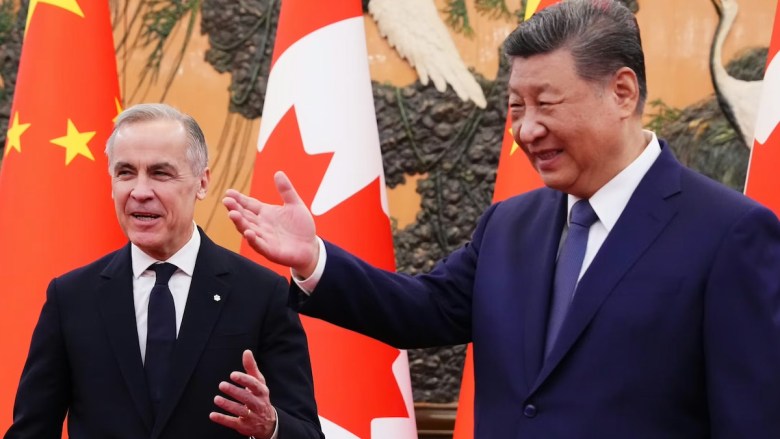

Canadian Prime Minister Mark Carney is actively seeking to expand Canada’s presence in the Asian market, underscoring the nation’s strategic pivot towards energy exports. Carney’s recent visit to Beijing and attendance at the ASEAN summit in October 2025 mark significant steps in this direction. The Indo-Pacific region, now considered the world’s primary economic engine, is vital for Canada, contributing up to 60% of global growth.

As Asian economies, including China and India, continue to show robust growth rates—4.2% and 6.6% respectively—Canada recognizes the need to diversify its trade relationships beyond its traditional focus on the United States. While countries like Japan and South Korea are experiencing modest growth rates between 1% and 2%, the demand for reliable energy sources remains a common priority across the region.

Strengthening Energy Partnerships

During the first day of Carney’s trip to China, Canada and China agreed to enhance cooperation in both clean and conventional energy sectors. This collaboration comes at a crucial time as stability and diversification of energy suppliers are becoming increasingly important. The energy needs in Asia are substantial and expected to rise in the coming years.

In the wake of the February 2025 trade war declaration by US President Donald Trump against Canada and Mexico, Ottawa has prioritized economic diversification. Carney’s election in April 2025 brought a shift in tone regarding economic issues, emphasizing the importance of transforming Canada into an energy superpower. This goal aligns with the needs of Asian countries, which are also focused on diversifying their supply chains and seeking politically stable trading partners.

Data from Statistics Canada reveals that combustible minerals, including oil, natural gas, and coal, accounted for 25% of Canadian exports in 2024. Despite this, 89.33% of these resources were shipped to the United States. To achieve Carney’s vision of an energy superpower, Canada must forge trade and energy partnerships with Asian nations.

Market Dynamics and Opportunities

The energy landscape in Asia remains heavily dependent on fossil fuels, with the International Energy Agency indicating that the industrial and transport sectors drive the largest share of energy demand. As urbanization and industrialization continue to accelerate in emerging countries, the reliance on coal persists, accounting for 49.3% of primary energy consumption in the Indo-Pacific region and 57% of electricity generation.

However, coal resources are dwindling, leading to a shift in energy strategies. Many developed economies in the region, including South Korea and Japan, import nearly all their oil and gas. Notably, China set a record in 2025 by importing 11.5 million barrels per day of crude oil, emphasizing the demand for stable energy supplies.

Southeast Asia is at a critical juncture, as evidenced by the ASEAN Oil and Gas Updates 2024 report, which indicates a gradual depletion of oil reserves and an expected transition to a net importer of gas by 2027. Governments in the region prioritize energy security and the transition to cleaner energy sources. Significant investments are underway in infrastructure, including new regasification and liquefaction plants, particularly in countries like Indonesia, Thailand, and Vietnam.

Canada’s recent advancements position it well to compete. With the inaugural shipment of Canadian LNG departing from the port of Kitimat, British Columbia, in July 2025, Canada aims to leverage its geographic advantages. The five multinational companies involved in this project include four from Asia: Petronas (Malaysia), PetroChina, Mitsubishi Corporation (Japan), and KOGAS (South Korea).

Despite challenges such as construction delays and rising costs, the expansion of the Trans Mountain Pipeline network has increased Canada’s oil export capacity to 890,000 barrels per day. As Asian demand for oil rises, Canada has witnessed a rapid increase in the price per barrel in recent months.

With the potential to capture a significant share of the Asian energy market, the question remains: will Canada successfully position itself as a dominant player, or will other nations seize the opportunity? The answer may redefine the geopolitical landscape and affect energy supply chains for years to come.

-

World5 months ago

World5 months agoSouth Korea’s Foreign Minister Cho Hyun to Visit China This Week

-

Business5 months ago

Business5 months agoStarling Bank Plans Secondary Share Sale, Targeting $5.4 Billion Valuation

-

Top Stories5 months ago

Top Stories5 months agoMunsang College Celebrates 100 Years with Grand Ceremony

-

World5 months ago

World5 months agoPAS Aims to Expand Parliamentary Influence in Upcoming Election

-

Business7 months ago

Business7 months agoKenvue Dismisses CEO Thibaut Mongon as Strategic Review Advances

-

Lifestyle6 months ago

Lifestyle6 months agoHumanism Camp Engages 250 Youths in Summer Fest 2025

-

Sports6 months ago

Sports6 months agoDe Minaur Triumphs at Washington Open After Thrilling Comeback

-

Sports7 months ago

Sports7 months agoTupou and Daugunu Join First Nations Squad for Lions Clash

-

Top Stories7 months ago

Top Stories7 months agoColombian Senator Miguel Uribe Shows Signs of Recovery After Attack

-

World7 months ago

World7 months agoASEAN Gears Up for Historic Joint Meeting of Foreign and Economic Ministers

-

Health6 months ago

Health6 months agoNew Study Challenges Assumptions About Aging and Inflammation

-

Business7 months ago

Business7 months agoOil Prices Surge Following New EU Sanctions on Russia