Business

Carro Achieves Record Revenue of S$1.2 Billion in FY2025

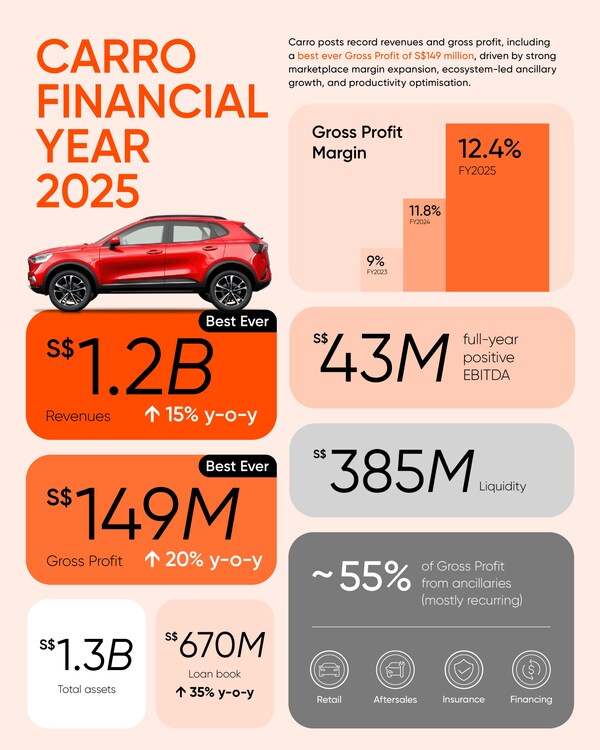

Carro, Asia Pacific’s leading online automotive platform, reported a record revenue of S$1.2 billion (approximately US$898 million) for the fiscal year 2025, marking a significant 15% increase compared to the previous year. Alongside this achievement, the company also recorded a gross profit of S$149 million (US$111 million), representing a robust 20% year-on-year growth. The results reflect Carro’s ongoing expansion and strategic initiatives to enhance profitability.

The company’s gross profit margin improved to 12.4%, up from 11.8% in FY2024. This increase was largely driven by ancillary services, which accounted for over 55% of the gross profit. Carro’s strong liquidity position stood at S$385 million (US$287 million), contributing to its financial stability.

Growth and Strategic Initiatives

Carro’s success can be attributed to its strategic focus on marketplace margin expansion and ecosystem-led income growth. According to audited FY2025 figures, the company achieved an EBITDA of S$43 million (US$32 million) and reported total assets of S$1.3 billion. The expansion into new markets, including Hong Kong and Japan, has positioned Carro as a significant player beyond Southeast Asia.

Aaron Tan, co-founder and Group CEO of Carro, emphasized the company’s commitment to enhancing its operations. “We continue to focus on driving marketplace margin expansion by cross-selling ancillaries to drive recurring income streams and improve customer lifetime value,” he stated. He also highlighted the launch of the Brand New segment in Singapore and Malaysia, aimed at capturing a broader customer base within the automotive value chain.

Carro’s fintech division, Genie Financial Services, has demonstrated impressive growth, with a 35% increase in its consumer loan book, reaching S$670 million (US$500 million). The division maintained a low non-performing loans (NPL) rate of below 0.5%, significantly better than regional industry standards.

Investment and Future Outlook

The company recently secured a US$60 million investment led by the Cool Japan Fund, Japan’s sovereign wealth fund. This funding is expected to bolster the demand for Japanese vehicles across the Asia Pacific region where Carro operates.

Ernest Chew, Chief Financial Officer of Carro, noted that despite challenging market conditions, the company’s focus on execution and financial discipline has resulted in record volumes, revenues, and improved profitability metrics. He remarked, “Our overall liquidity by the end of FY2025 improved year-on-year, as we continue to be extremely focused on financial discipline, vigilant on cash flows and working capital, and balance sheet strength.”

Carro’s efforts to diversify and securitize its receivables are aimed at enhancing financial flexibility. With its investment in Hong Kong proving to be strategically beneficial, the company is poised for continued growth in the coming years.

Founded in 2015, Carro has transformed the traditional automotive marketplace through its innovative use of technology, including proprietary pricing algorithms and AI-driven solutions. The company has raised over S$700 million from notable investors, including the Softbank Vision Fund. With over 4,500 employees across the Asia Pacific, Carro is well-positioned to maintain its leadership in the online automotive market.

For more information about Carro and its services, visit www.carro.co or contact [email protected].

-

Lifestyle3 months ago

Lifestyle3 months agoHumanism Camp Engages 250 Youths in Summer Fest 2025

-

Sports3 months ago

Sports3 months agoDe Minaur Triumphs at Washington Open After Thrilling Comeback

-

Business4 months ago

Business4 months agoKenvue Dismisses CEO Thibaut Mongon as Strategic Review Advances

-

Sports4 months ago

Sports4 months agoTupou and Daugunu Join First Nations Squad for Lions Clash

-

Top Stories4 months ago

Top Stories4 months agoColombian Senator Miguel Uribe Shows Signs of Recovery After Attack

-

World4 months ago

World4 months agoASEAN Gears Up for Historic Joint Meeting of Foreign and Economic Ministers

-

Business3 months ago

Business3 months agoOil Prices Surge Following New EU Sanctions on Russia

-

Health3 months ago

Health3 months agoNew Study Challenges Assumptions About Aging and Inflammation

-

Entertainment3 months ago

Entertainment3 months agoDetaşe-Sabah Violin Ensemble Captivates at Gabala Music Festival

-

Entertainment3 months ago

Entertainment3 months agoBaku Metro Extends Hours for Justin Timberlake Concert

-

Business3 months ago

Business3 months agoU.S. House Approves Stablecoin Bill, Sends to Trump for Signature

-

Top Stories4 months ago

Top Stories4 months agoRethinking Singapore’s F&B Regulations Amid Business Closures