World

China Launches Personal Loan Subsidy Amid Rising Youth Debt

The Chinese government has introduced a new personal loan interest subsidy aimed at stimulating consumer spending amidst a growing financial strain on the youth population. Effective from September 2023, the initiative is the first of its kind at the central government level and is intended to facilitate household consumption, particularly in priority sectors like automobiles, education, and healthcare.

Li Zi, a 34-year-old software engineer from Nanjing, is among those considering the subsidy as she prepares to purchase an electric car priced at approximately 285,000 yuan (about USD 43,900). The subsidy provides borrowers with a one-percentage-point reduction in loan interest for the first 50,000 yuan of any transaction. However, the benefits can be limited; for Li, this translates to a modest saving of around 500 yuan off her car loan.

Mixed Reactions to the Subsidy Scheme

The scheme has sparked skepticism among economists and potential borrowers. According to Liao Min, Vice Finance Minister, the initiative aims to bolster household spending and revive domestic consumption. Yet, analysts such as Hannah Liu from Nomura regard the subsidy as “well-intentioned” but predict minimal impact. Liu estimates that the total subsidy amount could reach no more than 5 billion yuan, a negligible figure against the backdrop of an estimated 500 billion yuan in new eligible consumer loans annually.

Concerns about the scheme’s effectiveness are echoed by Tian Xuan, Vice Dean at Tsinghua University’s PBC School of Finance. He notes that wealthier households with good credit histories are more likely to benefit, while lower-income groups may struggle to access the loans. Data from the People’s Bank of China indicates a significant shift in consumer behavior, with household savings increasing by nearly 48 percent from 2021 to 2024, reaching 151.25 trillion yuan. This highlights a preference for saving over spending, particularly among younger consumers.

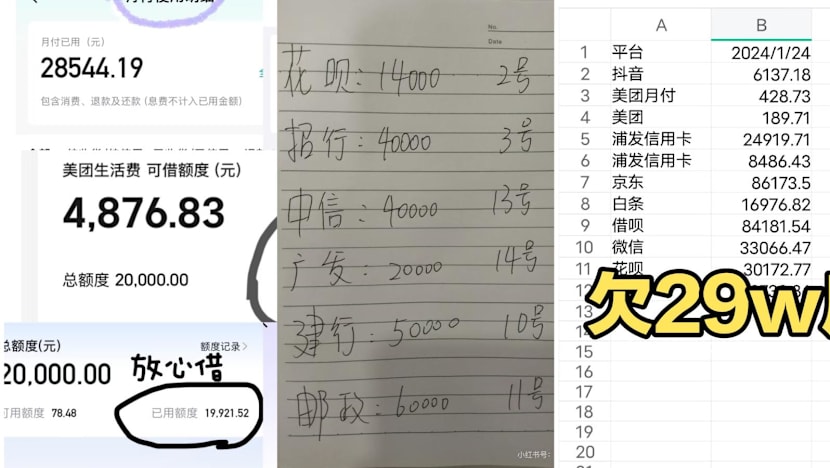

Furthermore, overdue credit card debt has surged by 44 percent during the same period, reflecting rising financial pressures. Many young individuals express anxiety that the new loan interest subsidies could exacerbate their debt burdens. “The impact of the loan subsidies on consumption will depend on income expectations and job stability,” Tian said.

Consumer Hesitance and Market Dynamics

Despite the anticipated benefits, early indicators suggest that potential borrowers remain cautious. A client service manager at a Bank of China branch in Shandong reported that while there have been inquiries about the subsidy, no applications have been submitted. Customers often cite issues such as eligibility criteria or simply seek more information.

The subsidy, available through 23 designated banks and financial firms, requires banks to conduct standard credit checks before granting loans. Once a loan is approved, the subsidy is automatically applied to repayments. Yet, many young consumers question the necessity of the subsidy amid existing online credit options that offer lower thresholds for borrowing.

For example, Caibao, a 22-year-old content creator in Beijing, relies on microloans for smaller purchases. He argues that existing platforms provide easier access to credit and would not consider the new subsidy. Similarly, Joe Zhou, a senior director in Guangzhou, prefers direct price reductions on products rather than interest subsidies, stating that the latter does not have the same immediate effect on purchasing decisions.

The scheme also reflects a broader concern about the implications of easy credit and rising debt. A 25-year-old nurse in Beijing, who identified herself as Xiao Ai, shared her struggles with debt accumulation, highlighting the mental health burdens associated with financial stress. Research firm Gavekal Dragonomics estimates that between 25 million and 34 million people in China defaulted on personal loans last year, a significant increase compared to levels in 2019.

As the Chinese government rolls out this subsidy alongside other measures, including a 300 billion yuan trade-in program and various childcare subsidies, officials remain hopeful that these initiatives will stimulate growth. However, experts emphasize that without addressing underlying issues such as wage stagnation and income inequality, the effects of such policies may be limited.

In the face of an upcoming Mid-Autumn Festival and National Day Golden Week, the government sees an opportunity to ease household pressures and boost consumer spending. Vice Finance Minister Liao stated, “Consumer demand is becoming more multi-layered and diverse,” and expressed optimism that the subsidy can genuinely assist households facing financial challenges.

With the effectiveness of the new loan interest subsidy still in question, many consumers are left pondering whether these measures will genuinely alleviate their financial burdens or simply add to their existing debts.

-

Business5 months ago

Business5 months agoKenvue Dismisses CEO Thibaut Mongon as Strategic Review Advances

-

Lifestyle4 months ago

Lifestyle4 months agoHumanism Camp Engages 250 Youths in Summer Fest 2025

-

Sports4 months ago

Sports4 months agoDe Minaur Triumphs at Washington Open After Thrilling Comeback

-

Sports5 months ago

Sports5 months agoTupou and Daugunu Join First Nations Squad for Lions Clash

-

Top Stories5 months ago

Top Stories5 months agoColombian Senator Miguel Uribe Shows Signs of Recovery After Attack

-

World5 months ago

World5 months agoASEAN Gears Up for Historic Joint Meeting of Foreign and Economic Ministers

-

Health4 months ago

Health4 months agoNew Study Challenges Assumptions About Aging and Inflammation

-

Business5 months ago

Business5 months agoOil Prices Surge Following New EU Sanctions on Russia

-

Entertainment4 months ago

Entertainment4 months agoDetaşe-Sabah Violin Ensemble Captivates at Gabala Music Festival

-

Entertainment4 months ago

Entertainment4 months agoBaku Metro Extends Hours for Justin Timberlake Concert

-

Top Stories5 months ago

Top Stories5 months agoRethinking Singapore’s F&B Regulations Amid Business Closures

-

Business5 months ago

Business5 months agoU.S. House Approves Stablecoin Bill, Sends to Trump for Signature