Taipei, March 21 (CNA) The Central Bank of the Republic of China (Taiwan) said on Thursday that it has raised its 2024 forecasts for Taiwan's gross domestic product (GDP) growth to 3.22 percent and consumer price index (CPI) growth to 2.16 percent after a quarterly policymaking meeting.

In a statement, the central bank said Taiwan is expected to benefit from a recovery in the global economy and stable private consumption, so it has thus decided to upgrade its GDP growth prediction to 3.22 percent from the 3.12 percent anticipated in December.

In terms of outbound sales, the central bank said Taiwan is expected to see a recovery in exports because emerging technologies, such as AI development, are likely to boost global demand.

Domestically, consumer confidence has also been improving, the bank added.

March 8: Taiwan's exports rise for 4th straight month in February

Feb. 27: Taiwan consumer confidence reaches 2-year high in February

The forecast showed the central bank was slightly more cautious than the Directorate General of Budget, Accounting and Statistics (DGBAS), which predicted in late February that Taiwan's economy would grow 3.43 percent in 2024.

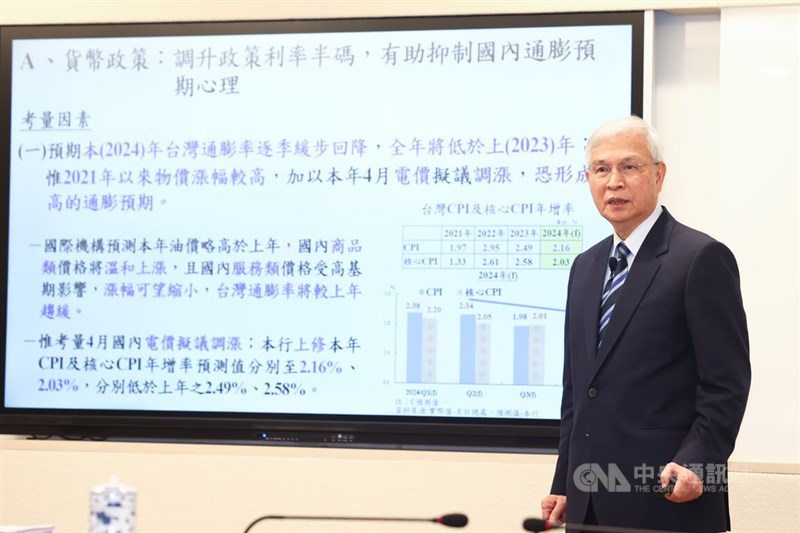

The central bank concluded its quarterly policymaking meeting Thursday, during which it announced a surprise 12.5 basis points rate hike, citing an expected spike in electricity tariffs for both household and industrial users starting from April.

After the surprise interest rate hike, Taiwan's discount rate will increase to 2 percent, the rate on accommodations with collateral will grow to 2.375 percent, and the rate on accommodations without collateral will rise to 4.250 percent. The rate hike will go into effect on Friday.

The central bank said the rate hike came after it took into account an expected increase in electricity tariffs, which will in turn boost CPI growth.

Electricity rates

The Ministry of Economic Affairs has scheduled a meeting for Friday to discuss a power rate increase for both household and industrial users in a bid to make up for the heavy losses shouldered by state-owned Taipei Power Co. (Taipower).

As a result, the central bank has raised its CPI growth forecast from an earlier 1.89 percent made in December to 2.16 percent, which is above the 2 percent alert set by the central bank.

In addition, the central bank has also raised its forecast of core CPI 2024 growth -- which excludes vegetables, fruits, and energy -- from 1.83 percent to 2.03 percent, also above the 2 percent alert.

In the first two months of this year, the CPI rose 2.43 percent from a year earlier after a 3.08 percent spike in February -- when the Lunar New Year holiday sparked a buying spree and added upward pressure to inflation.

Still, the central bank said inflation in 2024 is expected to ease from a 2.49 percent CPI increase and a 2.58 percent core CPI rise in 2023.

The central bank said the rate hike is expected to stabilize consumer prices and improve the local financial market.

March 14: Taiwan's 2024 CPI growth likely to top 2% on power rate hike: Central bank head

Feb. 29: Residential electricity rates set to rise in April after review: Taipower

Preventive measure

Speaking with reporters after the policymaking meeting, Yang Chin-long (楊金龍), governor of the central bank, admitted the interest rate hike was a "surprise," but an "appropriate" preventive measure.

Since the U.S. Federal Reserve and other foreign major central banks have hinted they will cut interest rates later this year, Yang said, the market may suspect the local central bank has failed to follow the global trend after the surprise rate hike on Thursday.

However, Yang said the local central bank has gradually tightened its monetary policy instead of the aggressive way the Fed and other foreign central banks have done so recently, and that the situation in Taiwan is different.

Yang said the bank will continue to closely watch how a hike in electricity rates and the goal to achieve net zero emissions in 2050 will affect inflation in Taiwan down the road.

Housing market

Since December 2020, the central bank has imposed five rounds of selective credit controls on the home market by limiting mortgages to home buyers to cap market speculation.

The central bank said in the statement that in addition to selective credit controls, the bank has gradually tightened its monetary policy, which has also helped the local banking sector control lending risks, and so it has therefore decided not to implement additional measures on the property market.

But, since home mortgages and other property-related lending have increased from the second half of last year, the central bank said it will continue to keep a close eye on the local property market and make possible adjustments in its selective credit controls.

After the interest rate hike on Thursday, Lai Chih-Chang (賴志昶), a researcher at Great Home Realty, said home buyers who have signed up for a 30-year NT$10 million (US$31,447) mortgage program are expected to have to pay an extra NT$631 in interest payments each month -- or NT$7,532 a year.

Tseng Ching-der (曾敬德), a research manager at Sinyi Realty Inc., said the increase in interest payments will cool down the home market to some extent in the short term but that there will likely not be a long-term impact.

Tseng said the latest interest rate hike aimed to tackle inflationary pressure caused by electricity tariffs, not to directly impact the home market.

But Tseng said home buyers should keep an eye on whether the central bank implements more interest rate hikes after Thursday's surprise move.

- Society

Thousands of Muslims gather across Taiwan for Eid al-Fitr prayers

04/10/2024 05:13 PM - Politics

New Cabinet to respond to domestic, global challenges: Lai

04/10/2024 04:55 PM - Society

Electronic pet ID card launched by agriculture ministry

04/10/2024 04:51 PM - Business

U.S. dollar closes lower on Taipei forex market

04/10/2024 04:11 PM - Business

TSMC reports highest sales for Q1

04/10/2024 03:52 PM